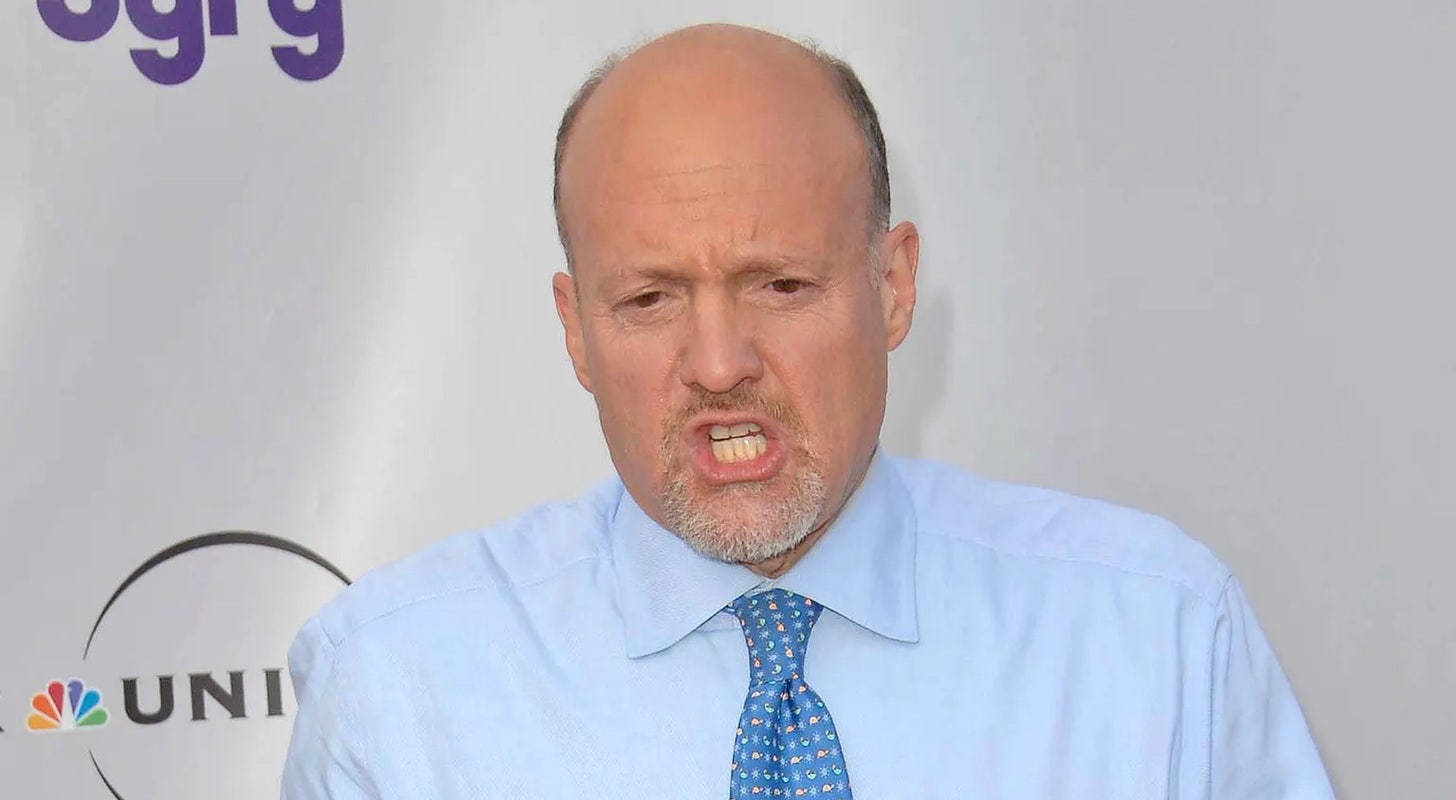

Jim Cramer Expects Drugmaker Stock To Go 'Even Higher,' As For Kroger: 'What The Heck Is Going On?' Inc., Jim Cramer, Todd Foley, Brent Bellm, The Kroger Co., Gary Millerchip, BigCommerce Holdings, Amazon.com (NASDAQ:AMZN), Parker-Hannifin Corporation, AST SpaceMobile (NASDAQ:ASTS) by https://www.benzinga.com/

AI Insights:

Simple Explanation:

A man named Jim Cramer talked about different companies and their stocks. He thinks a drugmaker company's stock will go higher and he is confused about what is happening with Kroger, a grocery store chain. He likes another company called Parker-Hannifin and does not like BigCommerce. Read from source...

Critical Perspective:

1. The headline is misleading and sensationalized, implying that Jim Cramer has a strong opinion on the future performance of drugmaker stocks and Kroger, when in fact he only briefly mentioned them as topics for further investigation or discussion.

2. The article lacks clear structure and coherence, jumping from one topic to another without providing any context or connection between them. This makes it difficult for readers to follow the main points and arguments of the author.

3. The use of quotations from Jim Cramer is selective and out of context, presenting a distorted view of his opinions and recommendations. For example, he said to hold off on Kroger until further information is available, but the article makes it seem like he is dismissing the company altogether.

4. The article relies heavily on external sources, such as Benzinga, without verifying or cross-referencing their credibility or accuracy. This creates a potential for misinformation and bias in the reporting of the news.

5. The tone of the article is overly negative and pessimistic, implying that there are no positive aspects or opportunities in the stock market or the companies mentioned. This may discourage readers from seeking more information or conducting their own research on these topics.

Investment Analysis:

We are not financial advisors. It's always essential for you to consult with a financial advisor and do your research before making any decisions about investments.

- Amazon (AMZN): Buy - AMZN is a dominant player in the e-commerce industry with strong growth potential and a diversified business portfolio. The company's cloud computing segment, AWS, also provides a stable source of income and competitive advantage. However, AMZN faces regulatory challenges and antitrust lawsuits that could affect its future performance and stock price.

- AST SpaceMobile (ASTS): Hold - ASTS is an interesting play on the emerging space economy and satellite connectivity market. The company's recent public offering of Class A common stock shows investor interest in its vision. However, ASTS is still in the early stages of development and commercialization, and faces significant competition from traditional satellite operators and other new entrants. Therefore, it may be too risky to invest in ASTS at this stage.

- Kroger (KR): Hold - KR has been struggling with declining sales and profit margins due to increased competition from online grocery retailers and discount stores. The recent departure of the CFO also raises concerns about the company's leadership and financial stability. However, KR still has a loyal customer base and a strong market position in the grocery industry. Therefore, it may be worth holding onto KR for now, but investors should monitor the situation closely and consider selling if the stock does not recover.

- Parker-Hannifin (PH): Buy - PH is a high-quality industrial company that provides motion and control technologies and systems. The company has a long history of consistent earnings growth, dividend increases, and share buybacks. PH also has a diversified customer base and operates in various end markets, including aerospace, automotive, construction, and energy. Therefore, PH is a solid investment option for long-term growth and income seekers.

- BigCommerce (BIGC): Sell - BIGC is an e-commerce software provider that enables online merchants to create and manage their online stores. The company has been benefiting from the growth of e-commerce due to the COVID-19 pandemic, but faces increasing competition from other platforms like Shopify and WooCommerce. Moreover, BIGC is not yet profitable and may face challenges in maintaining its revenue growth momentum as the economy reopens. Therefore, it may be best to sell BIGC and look for other opportunities in the e-commerce space.