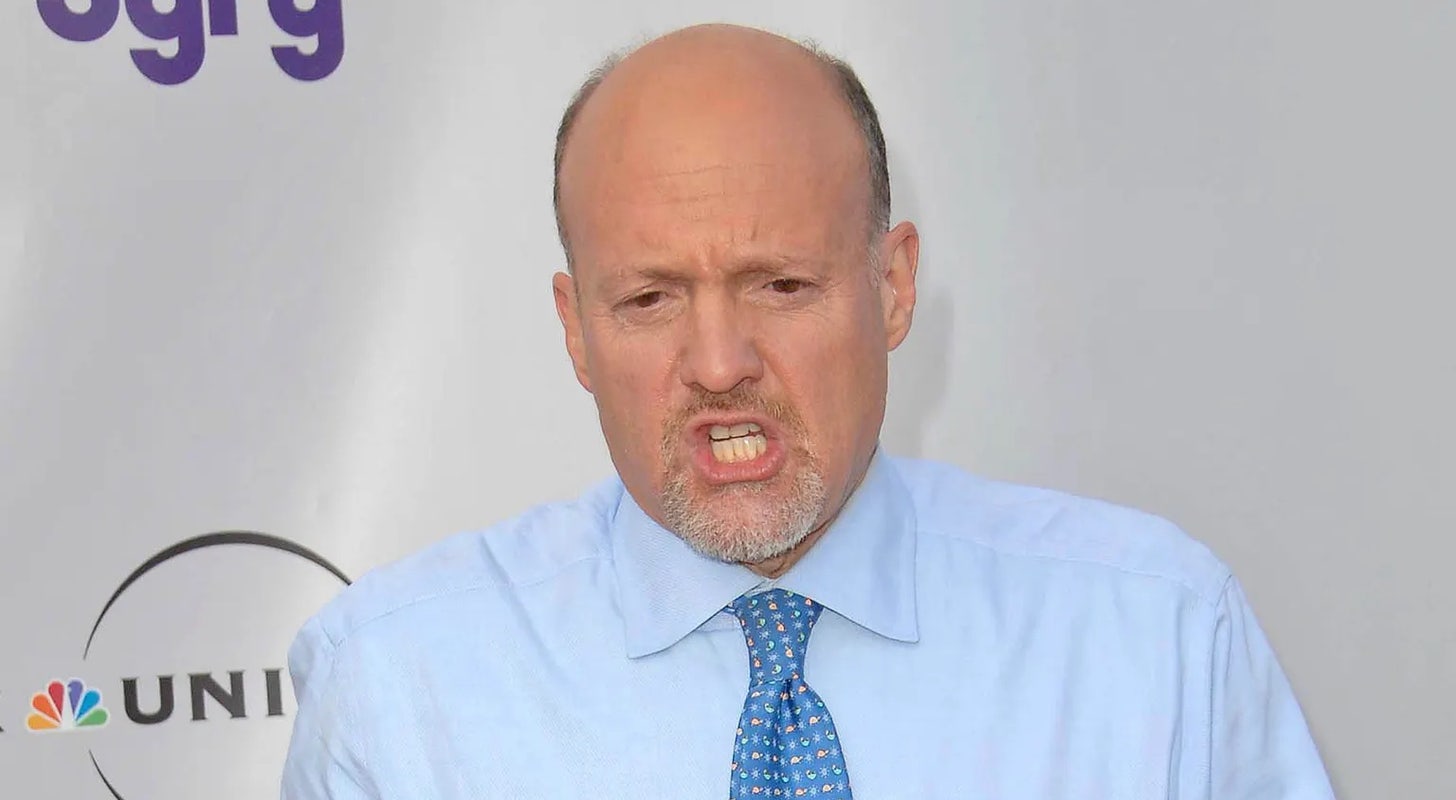

Jim Cramer Likes Trane Technologies 'Very Much' But Carrier is 'Undervalued Right Now' LLC, Inc., Jim Cramer, PDD Holdings, Trane Technologies, Comfort Systems USA, Celestica (NYSE:CLS), AvalonBay Communities, Digital World Acquisition, Carrier Global (NYSE:CARR), J&S Mechanical Contractors, Summit Industrial Construction, Taiwan Semiconductor Manufacturing by https://www.benzinga.com/

AI Insights:

Simple Explanation:

Jim Cramer is a famous person who talks about stocks, which are small parts of companies that people can buy and sell. He likes two companies called Trane Technologies and Carrier very much, but he thinks Carrier is not expensive enough right now. He also said something nice about Comfort Systems and another company called Celestica. Some other companies had their stock prices go up or down on a day last week. Read from source...

Critical Perspective:

1. The title is misleading and sensationalized, implying that Jim Cramer has a strong preference for Trane Technologies over Carrier Global, but in reality, he only mentioned them briefly as two companies he likes very much without comparing them directly or giving any reasons why one might be undervalued right now.

2. The article does not provide any evidence or analysis to support Jim Cramer's claims about Trane Technologies and Carrier Global being good investments, nor does it mention any potential risks or drawbacks of these companies. It simply repeats what he said without questioning its validity or reliability.

3. The article focuses on irrelevant details such as the acquisitions of Comfort Systems USA and J&S Mechanical Contractors, Inc., which are not related to Trane Technologies or Carrier Global's performance or prospects. These acquisitions might be interesting for some readers who follow these companies closely, but they do not add any value to the overall argument or provide any insight into why Jim Cramer likes them so much.

4. The article also mentions other stocks that are unrelated to Trane Technologies and Carrier Global, such as Celestica, PDD Holdings, Taiwan Semiconductor Manufacturing, AvalonBay Communities, and Digital World Acquisition. These stocks might be relevant for some readers who are interested in those sectors or markets, but they do not contribute to the main topic of the article, which is Jim Cramer's opinion on Trane Technologies and Carrier Global.

5. The article ends with a promotional message for another Benzinga article that has nothing to do with the original content, creating confusion and distrust among readers who might wonder why they are being directed to another unrelated article instead of receiving more information or analysis on Jim Cramer's opinion.

Investment Analysis:

We are not financial advisors. It's always essential for you to consult with a financial advisor and do your research before making any decisions about investments.

Based on the article, I can see that Jim Cramer likes Trane Technologies very much and thinks Carrier is undervalued right now. He also mentioned Comfort Systems as a good company. Here are my comprehensive investment recommendations and risks for each of these stocks:

1. Trane Technologies (TT):

- Strong buy recommendation, as Jim Cramer has praised the company and its performance.

- Risks include potential market fluctuations, economic downturns, and increased competition in the HVAC industry. However, these risks are relatively low for Trane Technologies due to its strong brand reputation and innovative products.

2. Carrier Global (CARR):

- Moderate buy recommendation, as Jim Cramer thinks it is undervalued right now. This implies that there is potential for growth in the future. However, the stock may be affected by external factors such as supply chain disruptions or changing consumer preferences.

- Risks include possible operational challenges, regulatory changes, and geopolitical tensions affecting global trade. These risks are moderate but should be monitored closely by investors.

3. Comfort Systems (CFRM):

- Strong buy recommendation, as Jim Cramer has indicated that it is a good company. The recent acquisitions of J&S Mechanical Contractors and Summit Industrial Construction also signal growth potential for the company.

- Risks include industry-specific challenges such as labor shortages, cost inflation, and regulatory compliance issues. However, these risks are mitigated by Comfort Systems' diversified portfolio of projects and strong customer base.