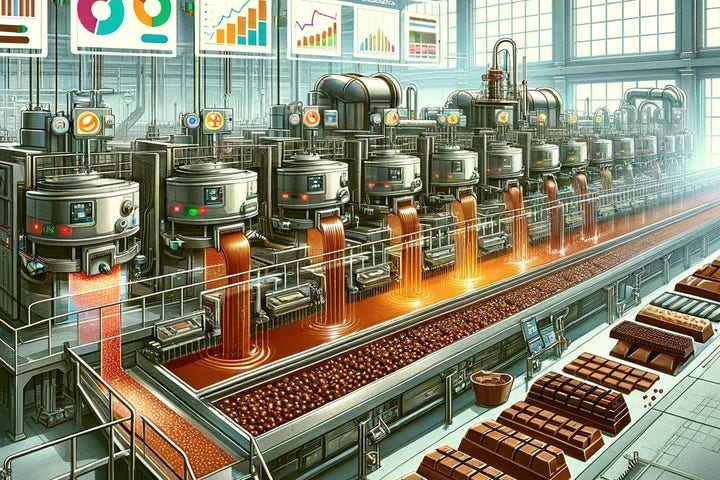

Inside Grön's Marijuana Edibles Factory: What Can We Learn About Choco-Nomics And Multi-State Expansion? Grön, Benzinga, New York, New Jersey, Ohio, Missouri, Pennsylvania, Cannabis Conference by https://www.benzinga.com/

AI Insights:

Simple Explanation:

This is an article about a company called Grön that makes special treats with cannabis, which is a plant that some people use to feel good or help with pain. They have a big factory where they make these treats and want to sell them in many places across the United States and Canada. The article talks about how they choose the best places to sell their treats based on things like rules and how much money they can make there. It also says that New York is a really good place for them because they can grow their brand and become more popular. Read from source...

Critical Perspective:

- The author uses anecdotal evidence and subjective language throughout the article, such as "significant", "promising", "unique", etc. These words do not provide objective or factual information about the economic dynamics of operating a cannabis edibles brand across various states.

- The author relies on quotes from Grön's CEO and other stakeholders, without providing any critical analysis or counterarguments. This creates a one-sided narrative that favors Grön and does not consider the perspectives of competitors, regulators, consumers, or social impacts of cannabis edibles.

- The author neglects to mention any potential challenges, risks, or drawbacks associated with Grön's expansion strategy, such as legal uncertainties, market saturation, pricing pressures, product safety, or public opinion. This paints an overly optimistic and unrealistic picture of the cannabis edibles industry.

Sentiment Analysis:

Neutral

Explanation: The article is mainly informative and does not express a clear sentiment towards the topic or any specific company mentioned in it. It discusses Grön's expansion strategy and market analysis but does not provide an opinion on whether this is good or bad for the cannabis edibles industry or its stakeholders.

Investment Analysis:

We are not financial advisors. It's always essential for you to consult with a financial advisor and do your research before making any decisions about investments.

AI can analyze various factors that may affect the performance and profitability of different cannabis edibles brands in various states, such as regulatory environment, market demand, competition, product quality, brand recognition, pricing strategy, distribution channels, etc. AI can also assess the potential risks and challenges associated with each state, such as legal uncertainties, taxation issues, supply chain disruptions, product recalls, etc.

Based on these factors and a comprehensive evaluation of the investment opportunities in the cannabis edibles industry, AI can provide the following recommendations:

1. Invest in Grön: Grön is a leading cannabis edibles brand with a strong track record of success across multiple U.S. and Canadian markets. Grön has a diverse product portfolio that caters to different consumer preferences and needs, ranging from chocolate bars to gummies, as well as innovative products like chocolate-infused coffee pods. Grön also has a robust distribution network that spans across eight U.S. and Canadian markets, allowing it to leverage its brand recognition and loyalty in new regions. Moreover, Grön's strategic expansion into New York, New Jersey, and Pennsylvania is expected to boost its revenue and profitability in the coming years, as these states offer significant market potential and favorable regulatory conditions for cannabis edibles. Therefore, investing in Grön seems to be a wise choice for those who seek long-term growth and stability in the cannabis edibles industry.