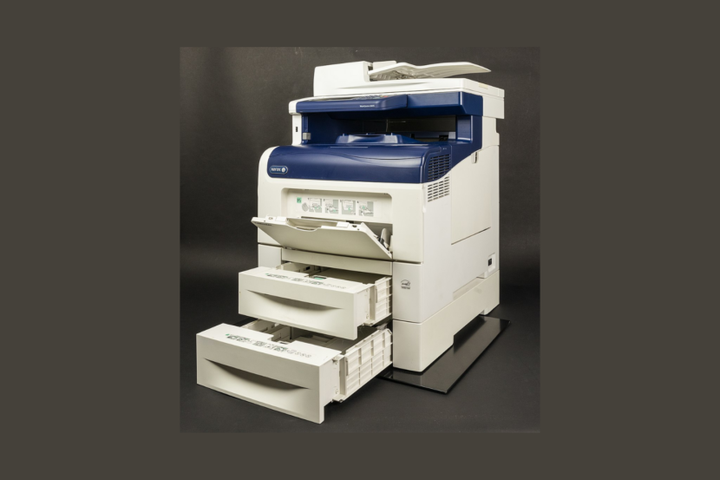

Xerox Loses Steam In Q1, Stock Dips Q1, Sales, Benzinga, Adjusted EPS, Xerox Holdings (NASDAQ:XRX), Equipment and post-sale revenues by https://www.benzinga.com/

AI Insights:

Simple Explanation:

A company called Xerox, which makes machines that copy papers and scan documents, did not do very well in the first three months of this year. They sold less stuff than they planned to and made less money than people expected them to. Because of this, the value of their stock went down a little bit. Read from source...

Critical Perspective:

1. The title is misleading and sensationalized. A 12.4% drop in sales is not a significant loss of steam, but rather a moderate decline that could be attributed to various factors. Moreover, the stock dip of 7.6% does not necessarily imply a permanent downtrend or a negative outlook for the company.

2. The article does not provide enough context or background information about Xerox's business model, its competitive advantages, its market share, or its strategic vision. It simply jumps to the numbers and results without explaining how they relate to the company's core value proposition or long-term goals.

3. The article uses vague terms such as "significant declines" and "misses estimates" without specifying what those estimates are, by whom, or how they were calculated. This creates a sense of uncertainty and confusion among the readers, who may not have access to the same data or analysis as the author.

4. The article does not mention any positive aspects or potential opportunities for Xerox, such as its innovation, customer loyalty, cost-saving initiatives, partnerships, or growth segments. It only focuses on the negative aspects and the short-term performance, which may not reflect the company's true value or prospects.

5. The article has a pessimistic and negative tone that does not inspire confidence or trust in the readers. It implies that Xerox is doomed to fail or underperform, without providing any evidence or reasoning for such a claim. It also ignores the possibility of external factors or uncertainties that may affect the company's results, such as the pandemic, the economic downturn, or the regulatory environment.

Investment Analysis:

We are not financial advisors. It's always essential for you to consult with a financial advisor and do your research before making any decisions about investments.

Possible answers:

- Based on the article, I think Xerox is not a good investment option right now because of its poor performance and low earnings. It has also faced significant declines in equipment and post-sale revenues, which could hurt its future growth potential. The stock price has dipped as a result of these negative factors, making it a risky bet for investors who are looking for long-term gains. I would advise against buying Xerox shares at this time unless you are willing to take on high volatility and uncertainty.