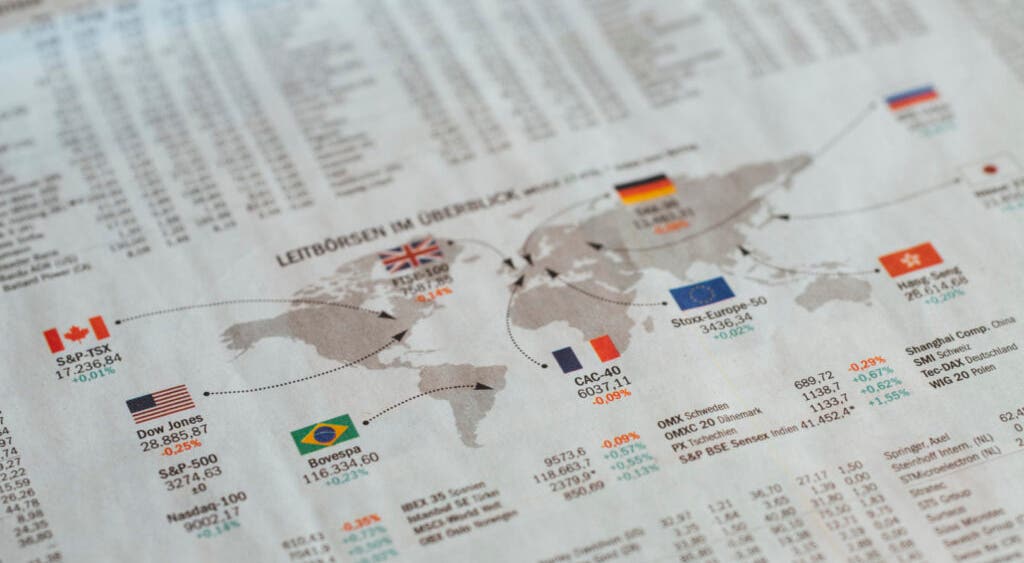

Asia Markets Mixed, Europe Gains, While Crude Oil Touches $82 - Global Markets Today While US Slept Gold, Silver, Copper, Benzinga, Brent oil, Natural Gas, Europe Gains, France's CAC, Germany's DAX, Crude Oil WTI, U.K.'s FTSE 100, India's Nifty 50, Asia Markets Mixed, Apple (NASDAQ:AAPL), European STOXX 50 index, Reserve Bank of Australia, China's Shanghai Composite, Ho.. by https://www.benzinga.com/

AI Insights:

Simple Explanation:

Okay kiddo, this is a news article about how different parts of the world's money markets are doing. Some places, like Asia and Europe, are making more money than before, while others, like China and India, are not doing so well. The price of oil and other things we use every day is going up, which means they cost more money now. This happens sometimes when the world's economy changes. Read from source...

Critical Perspective:

- The title is misleading and sensationalized. It implies that Asia markets are mixed while Europe gains, but it does not explain how or why this situation occurred. It also suggests a contrast between crude oil touching $82 and the US sleeping, which seems to have no logical connection or relevance to the rest of the article.

- The article lacks coherence and structure. It jumps from one market index to another without providing any context, analysis, or comparison. It does not explain the factors that influenced the performance of each market, nor how they relate to each other or to global economic trends.

- The article uses vague and ambiguous terms such as "led by gains" and "slid", which do not convey any specific information or insight. It also repeats some information unnecessarily, such as mentioning the interest rates in Australia twice, without adding anything new or relevant to the reader.

- The article is biased and subjective. It uses words like "lower" and "declined" to describe the performance of Asian markets, while using positive terms like "gained" and "rose" for European markets, implying a favorable view of the latter over the former. It also does not provide any evidence or data to support its claims or opinions, relying on speculation and anecdotes instead.

- The article has emotional tone and language. It uses words like "slipped", "moderation", "too high", "down", and "lower" to convey a negative impression of the Asian markets, while using words like "up", "high", and "rise" for the European markets, creating a contrast between them that may appeal to emotions rather than logic. It also uses hyperbole and exaggeration, such as saying that crude oil touched $82, which is not accurate or relevant to the article's main topic.

Investment Analysis:

We are not financial advisors. It's always essential for you to consult with a financial advisor and do your research before making any decisions about investments.

- The US market is expected to open lower, as indicated by the Dow futures and other indicators mentioned in the passage. This suggests a potential bearish trend for the day or at least a temporary pullback from recent gains. Investors should be cautious and consider taking profits or reducing exposure to riskier assets.

- The European market is showing mixed signals, with some indices gaining while others are flat or lower. This indicates that there may be some uncertainty or divergence among the regional economies, which could affect the overall performance of the European stocks. Investors should monitor the news and economic data for clues about the direction of the market.

- The Asian markets are also mixed, with some sectors performing better than others. This reflects the diversity and complexity of the Asian economies, which may be affected by various factors such as inflation, interest rates, geopolitical tensions, or COVID-19 situation. Investors should pay attention to the specific developments in each market and sector, and consider adjusting their portfolios accordingly.

- Crude oil is trading slightly lower, which could be a relief for some investors who are concerned about the rising energy costs and its impact on inflation and growth. However, it could also indicate a weakness in the demand or a strengthening of the supply, depending on the underlying factors. Investors should keep an eye on the oil prices and their implications for the economy and the stock market.

- Commodities are mostly lower, except for natural gas, which is gaining due to concerns about the winter shortage and the cold weather in some regions. This could be a temporary bounce or a sign of a longer-term trend, depending on how the supply and demand balance out. Investors should be careful not to chase after high-flying commodities without doing proper research and risk management.

- The US dollar is stronger against most major currencies, which could help boost the demand for American exports and ease some of the inflationary pressure. However, it could also create challenges for the emerging markets that rely on foreign capital and face higher borrowing costs. Investors should consider the currency impact on their portfolios and hedge accordingly if needed.

- The Australian dollar is weaker against the US dollar, which could be a negative sign for the Australian economy and the stock market, as it reflects lower confidence and growth prospects. However, it could also provide an opportunity for bargain hunters who see value in some of the undervalued sectors or companies. Investors should look for signs of improvement or deterioration in the economic data and the earnings outlook.

- The Indian rupee is weaker against the US dollar, which could be a