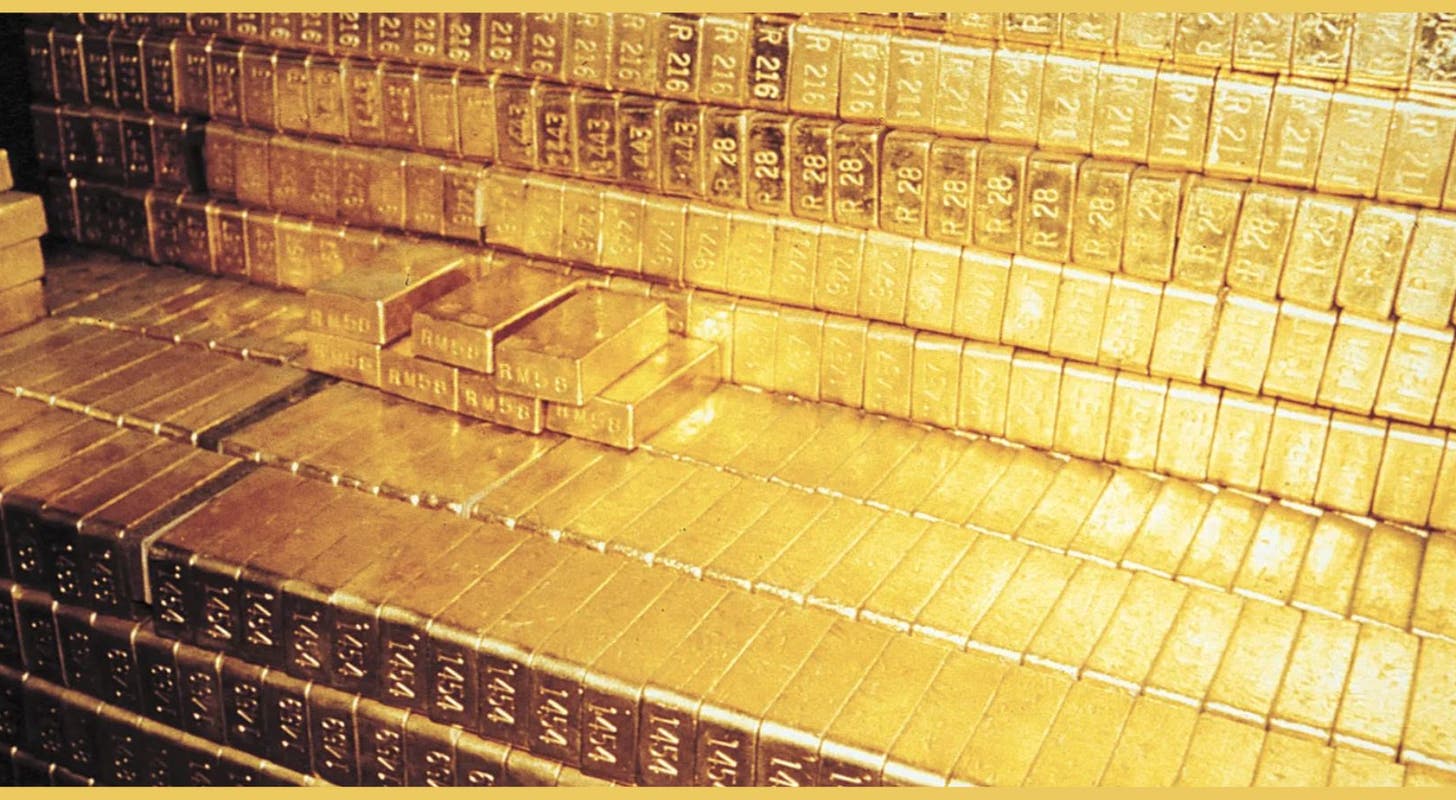

Gold Moves Lower; Pilgrim's Pride Earnings Top Views NASDAQ, S&P 500, Agiliti, Aclarion, Energy shares, Dow Jones index, Utilities shares, Fourth-quarter fiscal 2023, Pilgrim's Pride Corporation by https://www.benzinga.com/

AI Insights:

Simple Explanation:

A company called Pilgrim's Pride made more money than people thought they would in the last three months of 2023. They sold $4.5 billion worth of chicken and other food, which is a lot more than the $4.4 billion that experts guessed. This made them do well compared to other companies in their industry. The value of gold went down a little bit on Monday, while some types of businesses like energy did better than others, such as utilities, which didn't do so well. Read from source...

Critical Perspective:

- The article title is misleading and does not reflect the main content of the article. It implies that gold prices are falling and Pilgrim's Pride earnings are the most important news, but in reality, both topics are given equal weight and no clear comparison or relation between them is established. A better title would be "Mixed Stock Market Performance; Pilgrim's Pride Beats Earnings Expectations".

- The article starts with a vague and generic description of the stock market performance, without specifying which indices, sectors, or time frame are being referred to. This makes it difficult for readers to understand the context and significance of the changes mentioned in the article. A more informative introduction would be "U.S. stocks traded mixed on Friday, with the Dow Jones index falling by 0.24% and the NASDAQ rising by 0.5%, while the S&P 500 remained almost unchanged".

- The article uses the term "leading and lagging sectors" without explaining what criteria or methodology is used to determine them. This creates confusion and ambiguity for readers who may not be familiar with stock market jargon or classification schemes. A more transparent and accurate way of presenting this information would be "Energy shares rose by 1.7% on Friday, outperforming the overall market, while utilities shares fell by 0.5%, underperforming the market".

- The article focuses too much on Pilgrim's Pride earnings and does not provide any context or analysis of why they are important or relevant for investors or consumers. It also fails to mention any potential challenges, risks, or opportunities that the company may face in the future. A more balanced and insightful approach would be "Pilgrim's Pride reported better-than-expected fourth-quarter sales growth of 9.7% year-over-year to $4.528 billion, driven by strong demand for poultry products amid the COVID-19 pandemic. However, the company also faces headwinds from rising input costs, labor shortages, and competition from other meat producers".

- The article ends with a link to another article that is unrelated to the main topic and does not provide any value or continuity for readers who are interested in learning more about the subject. It seems like an attempt to generate more clicks and traffic without offering any meaningful information or insight. A more useful and relevant conclusion would be "For more stock market news and analysis, please read our recent articles on Intuitive Machines, Marriott International, and Agiliti".

Investment Analysis:

We are not financial advisors. It's always essential for you to consult with a financial advisor and do your research before making any decisions about investments.

Given that gold moved lower today, it may not be a good time to invest in gold-related stocks or ETFs. However, the energy sector performed well, indicating that there could be potential opportunities in this area. The Pilgrim's Pride earnings report was positive and exceeded expectations, which could be a signal for other food companies to follow suit. Therefore, one possible investment recommendation is Agiliti (NYSE:AGTI), a healthcare services provider that has been steadily growing its revenue and expanding its operations. AGTI could benefit from the increasing demand for healthcare services as the population ages and requires more medical care. Additionally, Aclarion (NASDAQ:ACON) is another company worth considering, as it develops advanced hearing aid technologies that could improve the quality of life for millions of people with hearing impairments. ACON has a strong patent portfolio and partnerships with leading hearing aid manufacturers, which could provide a competitive edge in this growing market.

As for risks, AGTI faces competition from other healthcare providers and insurance companies that may limit its pricing power and profit margins. Furthermore, ACON's success is dependent on the adoption of its products by hearing aid manufacturers and consumers, which could be influenced by factors such as price, quality, and consumer preferences. Therefore, both AGTI and ACON have some challenges to overcome before they can achieve consistent growth and profitability. However, given their potential for innovation and market expansion, they may still offer attractive investment opportunities for risk-tolerant investors.