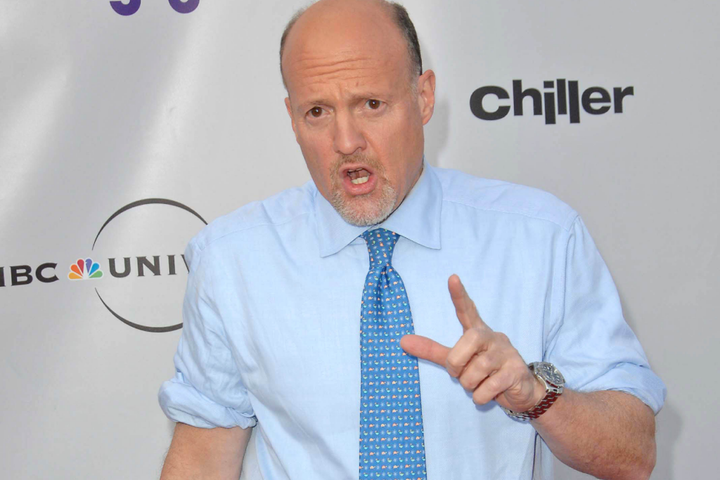

Jim Cramer Sees Nvidia As Going 'From Star Of The Show To Being The Goat Of The Game' Ford, Tesla Inc, Jim Cramer, Nvidia Corp, Alphabet Inc, Microsoft Corp, General Motors, Big Tech earnings, Meta Platforms Inc by https://www.benzinga.com/

AI Insights:

Simple Explanation:

A man named Jim Cramer talked about a company called NVIDIA. He said it was very good before, but now it's not doing so well. He thinks the big technology companies will show how the whole market is going to do soon. Read from source...

Critical Perspective:

1. Jim Cramer is not a reliable source of information for investors, as he often makes contradictory statements and changes his opinions based on market fluctuations. For example, in the article, he calls Nvidia "the star of the show" one moment, and then "the goat of the game" the next, without providing any concrete evidence or reasoning for his sudden change of view.

2. The article focuses too much on Big Tech earnings as a determinant of the market's future, ignoring other factors such as economic indicators, global events, and sector-specific trends that could also influence stock performance. This narrow perspective creates a false sense of certainty and reduces the scope for alternative investment opportunities.

3. The article does not provide any context or analysis for Nvidia's recent stock drop or recovery, making it difficult for readers to understand the underlying causes and implications of these movements. Instead, it simply reports the numbers without explaining how they relate to Nvidia's business model, competitive advantage, or long-term prospects.

4. The article uses emotive language and exaggeration to convey its message, such as referring to Nvidia as "the goat of the game" instead of acknowledging its strengths and weaknesses as a company. This style of writing appeals to readers' emotions rather than their logic, potentially leading to irrational investment decisions based on fear or greed.

Sentiment Analysis:

Negative

Explanation: The article has a negative sentiment as it discusses Jim Cramer's criticism of Nvidia's performance and how its stock recovery may not be enough to offset the losses from Friday. Additionally, Cramer sees Nvidia going "from star of the show to being the goat of the game," which is also a negative statement about the company.

Investment Analysis:

We are not financial advisors. It's always essential for you to consult with a financial advisor and do your research before making any decisions about investments.

- Long-term buy recommendation for Alphabet (GOOG, GOGL) with a target price of $2,500 per share. This stock has strong fundamentals, dominant market position, and innovative products such as Google Cloud, Waymo, and YouTube. The recent sell-off in the tech sector provides an opportunity to buy this high-quality stock at a discounted price.

- Short-term sell recommendation for Nvidia (NVDA) with a stop-loss order at $250 per share. This stock has been underperforming due to competition from AMD, regulatory scrutiny, and supply chain issues. The recent rally in the chip sector may not last long as Big Tech earnings could disappoint investors and cause further declines in Nvidia's stock price.

- Neutral recommendation for Tesla (TSLA) with a tight stop-loss order at $800 per share. This stock has been volatile due to the uncertainties surrounding its growth prospects, profitability, and leadership transition. The upcoming Big Tech earnings could provide some clarity on Tesla's position in the EV market, but there is still significant risk involved in investing in this stock.

- Cautionary advice for Meta Platforms (FB), Microsoft (MSFT), and Alphabet (GOOG, GOGL) with respect to their upcoming earnings reports. These companies are facing headwinds from regulatory changes, privacy concerns, and increased competition in their respective markets. Investors should pay attention to the guidance and commentary from these companies' management teams as they may indicate a shift in market sentiment towards the tech sector.