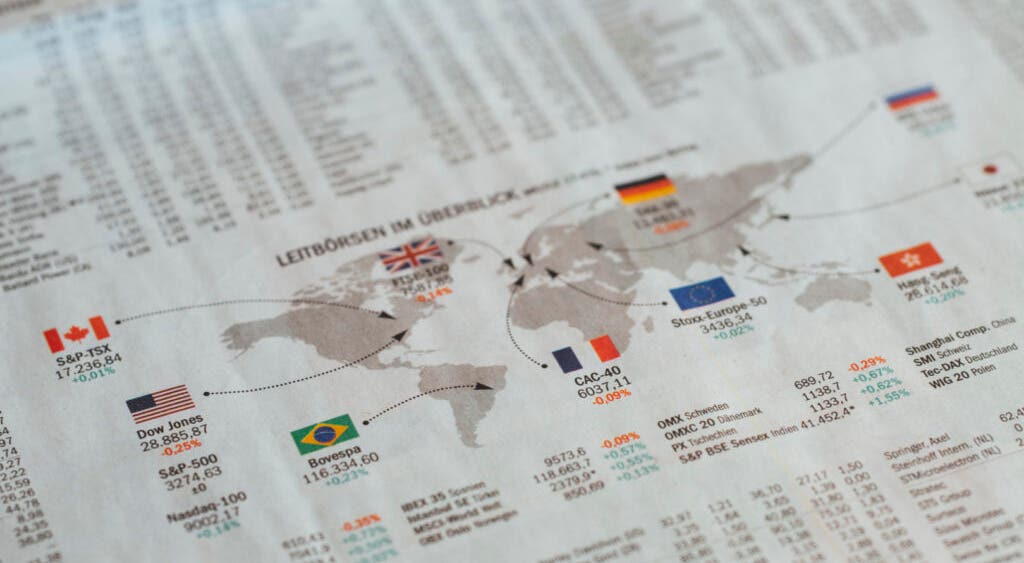

Asia Markets Mixed, Europe Gains, Crude Oil Falls 1.5% - Global Market Overview While The US Slept S&P 500, Benzinga, Jim Cramer, Japan Markets, Nasdaq Composite, Shenzhen CSI 300, Australia's S&P/ASX 200, China's Shanghai Composite, Hong Kong's Hang Seng Index, Dow Jones Industrial Average, India's Nifty 50 and Nifty 500, SmartETFs Asia Pacific Dividend Builder ETF by https://www.benzinga.com/

AI Insights:

Simple Explanation:

A group of people who watch and write about how different things are bought and sold around the world saw that some places in Asia were doing okay, but not all of them. Europe was doing well and making more money. The price of oil went down a lot. Some big companies made good results and everyone talked about it. Read from source...

Critical Perspective:

- The title is misleading and does not reflect the content of the article. It implies that there is a contrast between Asia markets being mixed and Europe gaining, while in reality, they are separate events that happen independently. The title should be more neutral or descriptive, such as "Asia Markets Mixed, Europe Gains, Crude Oil Falls - Global Market Overview".

- The article does not provide any explanation for the reasons behind the market movements, which makes it less informative and educational for readers who want to understand the underlying factors and trends. A possible way to improve this is by adding some charts or graphs that show the changes in key indicators or sectors over time, and comparing them with historical data or expectations.

- The article focuses too much on the short-term fluctuations of the markets, which can be confusing and misleading for readers who are looking for longer-term investment strategies or insights. A better approach would be to also include some analysis of the underlying trends or factors that affect the markets in the long run, such as demographics, technological innovation, geopolitical risks, etc.

- The article uses vague and ambiguous terms, such as "gains" and "falls", which do not convey the magnitude or significance of the market changes. For example, it would be more informative to specify how much crude oil fell by percentage points, or what the impact of Europe's gains is on the global economy or trade balance.

- The article does not provide any context or background information for readers who are not familiar with the markets or the region. For example, it would be helpful to explain what the S&P 500 or the Nasdaq Composite are, how they measure the performance of the stock market, and why they are important indicators of economic health.

- The article has a biased tone that favors certain perspectives or interests over others. For example, it mentions Nvidia's results and demand dynamics in a positive light, without acknowledging any challenges or risks that the company may face. It also implies that technology stocks are leading the growth in the market, while ignoring other sectors that may have more potential or value. A more balanced and objective approach would be to present different viewpoints or scenarios, and support them with data or evidence.

Sentiment Analysis:

Positive

Summary:

The article reports on mixed performances of Asian markets and gains in Europe while crude oil prices fell 1.5%. The US market experienced significant growth with the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all rising. Technology stocks led the growth in the US, with utilities being the only declining sector. In Asia, Australia's market rose slightly while Japan was closed for a holiday. India's Nifty 50 closed lower by 0.02%, China's Shanghai Composite and Shenzhen CSI 300 gained, and Hong Kong's Hang Seng Index declined. The article has a positive sentiment as it highlights the gains in various markets and sectors despite mixed performances in Asia.